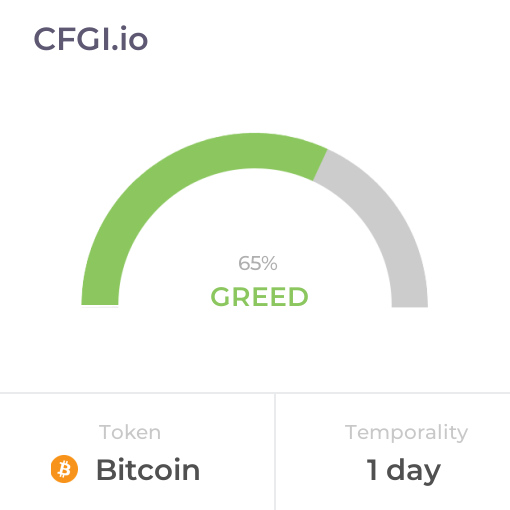

Historical Values

-

Now

Fear 23 -

Yesterday

Fear 23 -

7 Days Ago

Fear 23 -

1 Month Ago

Fear 23

Bitcoin Breakdown

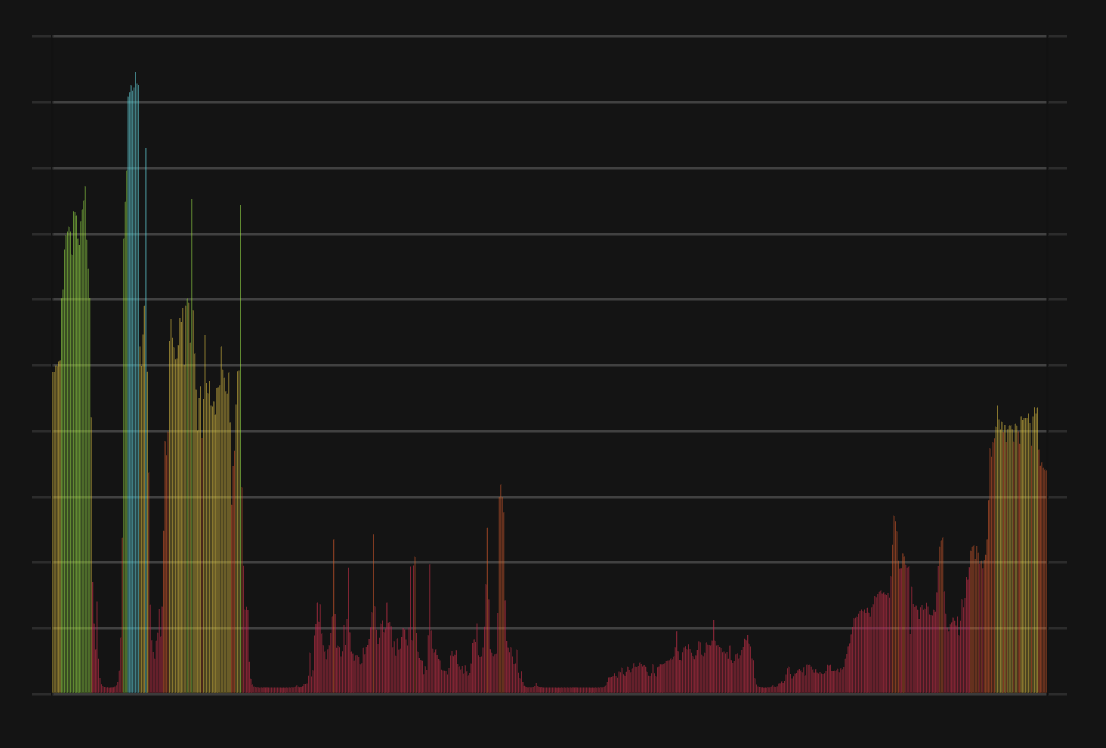

Price Score Fear

The Price Score indicator is a relevant indicator to analyze and assign the Bitcoin price evolution a certain numerical value.

This module studies the price trend to determine if the Bitcoin market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Extreme Fear

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Bitcoin price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Fear

Like volatility, the Bitcoin Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Bitcoin bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Extreme Fear

The Impulse indicator measures the current Bitcoin price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Bitcoin market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Fear

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Bitcoin the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Fear

Dominance Greed

This other indicator takes into account the dominance of Bitcoin with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Bitcoin's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Bitcoin and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Fear

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Bitcoin has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Bitcoin. For this, specific search terms are used that determine the purchasing or ceding interest of Bitcoin, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Greed

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Bitcoin and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Bitcoin moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Neutral

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Bitcoin on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

Bitcoin News

Bitcoin News

Binance moves 1,315 BTC in internal reserve reclassification into SAFU Fund

Sentiment: Positive

Read moreCrypto Market Crash: Why Are BTC, XRP, ETH, and DOGE Prices Falling Today?

Sentiment: Negative

Read moreBinance moves 1,315 bitcoin into SAFU fund as it prepares to buy $1 billion BTC

Sentiment: Positive

Read moreXRP and BTC Price Prediction if Michael Saylor Dumps Bitcoin Following Crypto Market Crash

Sentiment: Negative

Read more$704,000,000 in Bitcoin and Crypto Liquidated As BTC Price Plunges To $74,600

Sentiment: Negative

Read moreStrategy's Bitcoin Holdings Face $900M in Losses as BTC Slips Below $76K

Sentiment: Negative

Read moreBitcoin Weekly Outlook: Can BTC Hold $75K Support With Fed, Jobs Data in Focus?

Sentiment: Negative

Read moreWill MSTR stock price fall as Strategy's BTC holdings slip into $900M unrealized loss?

Sentiment: Negative

Read moreCrypto prices today (Feb. 2): BTC dips below $77K, XRP, LINK, XMR slide amid market crash

Sentiment: Negative

Read moreWhere Are Bitcoin Bulls? Jim Cramer Questions Absence as BTC Struggles Below $80K

Sentiment: Negative

Read moreSleeping Stashes Blink: Early Bitcoin Wallets Shift Nearly 5,000 BTC in January

Sentiment: Neutral

Read more12-Year Old Bitcoin Holder Offloads More Than $260 Million BTC, What Does it Signal?

Sentiment: Negative

Read moreBitcoin price forecasts tap sub-$50K levels as BTC copies old bear markets

Sentiment: Negative

Read moreMichael Saylor signals another bitcoin buy as BTC price slumps to $78,000

Sentiment: Positive

Read more$200 Billion Gone From Crypto Markets as BTC, ETH, XRP Tanked on Saturday: Weekend Watch

Sentiment: Negative

Read moreBitcoin Price Prediction: BTC Slips to $78K as Gold and Silver Crash – Is the Sell-Off Over?

Sentiment: Negative

Read moreBTC drops below $80,000 following $1.6 billion in monthly ETF outflows, third-worst month on record

Sentiment: Negative

Read moreBitcoin ETFs extend four-day outflow streak while BTC stalls near $83,000

Sentiment: Negative

Read moreBitcoin Price Prediction: How Deep Could BTC Fall if $80K Support Breaks?

Sentiment: Negative

Read moreBitcoin Price Prediction: $50B Volume Drops as BTC Tests $83K – Is a Breakdown Next?

Sentiment: Negative

Read morePi Network's PI Token Finally Rebounds, Bitcoin (BTC) Settles at $83K: Weekend Watch

Sentiment: Positive

Read moreTennessee Advances Bitcoin Reserve Bill as Strategic BTC Adoption Grows in the U.S

Sentiment: Positive

Read moreBitcoin To $30,000? Analysts Warn BTC Crash Could Be Deeper Than Expected

Sentiment: Negative

Read moreNorway's Wealth Fund Ramps Up Indirect Bitcoin Exposure to 9,573 BTC in 2025

Sentiment: Positive

Read more370,000 BTC a Month: How Long-Term Holder Spending Defies Network Metrics

Sentiment: Positive

Read morePrice predictions 1/30: BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH, HYPE, XMR

Sentiment: Negative

Read moreNet Metrics Miss the Real Story as Long-Term Holders Spend 370,000 BTC Monthly

Sentiment: Negative

Read moreBitcoin Rainbow Chart Signals ‘Fire Sale' Zone as BTC Enters Undervalued Territory

Sentiment: Positive

Read moreBitcoin ETFs Bleed $817M as BTC Crashes to 9-Month Low – Is the Worst Over?

Sentiment: Negative

Read moreBitcoin Price Prediction: $1.875 Billion Pulled From BTC – Are We Hours Away From a Major Breakdown?

Sentiment: Negative

Read moreBitcoin Whale Accumulation Hits Highest Level Since 2024 Amid BTC Price Weakness

Sentiment: Positive

Read moreBitcoin Slips To Nine-Month Low Below $82,000 As Wall Street Withdraws $818M From BTC ETFs In A Day

Sentiment: Negative

Read moreNorway sovereign wealth fund's indirect bitcoin exposure grew 149% in 2025 to 9,573 BTC: K33

Sentiment: Positive

Read moreBitcoin Price Drops Below $83,000 as Satoshi Nakamoto Loses $8 Billion in BTC Value

Sentiment: Negative

Read moreLiquidity Builds Above Bitcoin (BTC) Price—Bearish Signal or Short Squeeze Setup?

Sentiment: Neutral

Read moreWill BTC, ETH and XRP Rally As Trump Formally Nominates Kevin Warsh as Fed Chair?

Sentiment: Positive

Read moreBitcoin Crashes to $81,000 Early Friday: Bear Market Confirmed or Capitulation Bottom? – BTC TA January 30, 2026

Sentiment: Negative

Read moreBitcoin Price Prediction: BTC Dumps to $82.6K as Fed Chair Talk and Liquidations Hit

Sentiment: Negative

Read moreBTC Leads Dips in Crypto Prices Ahead of Trump's Imp Call and Global Financial Crisis Chance

Sentiment: Negative

Read moreLondon BTC moves into gold ventures as its hedging strategy get underway

Sentiment: Positive

Read moreBinance to Move $1B SAFU Fund Into Bitcoin Reserve Despite BTC Price Dip

Sentiment: Positive

Read moreBTC Price Prediction: Bitcoin Eyes $95,000 Recovery by February Amid Technical Oversold Signals

Sentiment: Positive

Read moreBinance to convert $1B SAFU reserve from stablecoins to BTC in long-term bet

Sentiment: Positive

Read moreCrypto prices today (Jan. 29): BTC dips below 83K, SOL, ZEC SUI slide as liquidations top $1.6B

Sentiment: Negative

Read moreBitcoin Price Forecast: BTC Eyes $70K as Fed Rate Cut Hopes Fade on Warsh Buzz

Sentiment: Positive

Read moreBitcoin, Ethereum, XRP, Dogecoin Tank Amid Tech Rout; Gold Also Cools: Analyst Flags Key BTC Support, Resistance Levels

Sentiment: Negative

Read moreBitcoin Price Prediction: BTC Slips to $83K but These Behind-the-Scenes Signals Are Turning Heads

Sentiment: Positive

Read moreBitcoin Price Forecast: Bear Flag Confirmed as Sellers Dump BTC – $36K Next?

Sentiment: Negative

Read moreJapan's Biggest Bitcoin Treasury Firm Just Raised $137 Million to Buy Even More BTC

Sentiment: Positive

Read moreRekt Capital Warns Bitcoin Mirroring 2021 Pattern That Preceded 55% BTC Price Nosedive

Sentiment: Negative

Read moreBTC Price Crashes Below $85K Amid U.S.-Iran Tensions and Hawkish Fed Pivot

Sentiment: Negative

Read moreChina Needs Only 4,012 BTC To Surpass US Bitcoin Holdings Despite Blanket Ban

Sentiment: Positive

Read moreHistorical Values

-

Now

Fear 23 -

Yesterday

Neutral 23 -

7 Days Ago

Fear 21 -

1 Month Ago

Fear 21

Bitcoin Breakdown

Price Score Fear

The Price Score indicator is a relevant indicator to analyze and assign the Bitcoin price evolution a certain numerical value.

This module studies the price trend to determine if the Bitcoin market has a bearish or bullish trend.

The main trend defines one part of the general sentiment of the market, and is a factor of weight when analyzing a chart. A pronounced and long-lasting positive trend generates a greater feeling of greed. In the same way, when the trend is negative, a greater feeling of fear is generated, regardless of other factors.

Volatility Extreme Fear

Price Volatility is also another important indicator and the biggest trigger for market sentiment. To measure it, we use values between 0 and 1 that determine the degree of current Bitcoin price fluctuation for the desired time frame.

Higher volatility implies a riskier market, which further polarizes bullish and bearish sentiments. An increase in volatility implies greater greed in a bull market, but also greater fear in a bear market.

Volume Fear

Like volatility, the Bitcoin Volume is a determining factor.

An increase in the volume implies a greater negotiation in the market, which is caused by an increase in the movements caused by an interest, which is synonymous with great sentiment. A strong volume determines a strong level of greed in Bitcoin bull markets, but also a strong level of panic in bear markets.

Like volatility, it is also calculated with a range between 0 and 1.

Impulse Extreme Fear

The Impulse indicator measures the current Bitcoin price strength compared to previous values to determine in a range from -1 to 1 how it is affecting the Bitcoin market sentiment.

Impulse has a huge impact on sentiment, as on a psychological level we tend to place more importance on the latest price move.

The strength of this shows price inclination that can be more or less pronounced and determines the polarity. A strong bullish impulse in a market implies a greater feeling of greed, in the same way that a strong bearish impulse generates a greater feeling of fear or panic.

Technical Fear

It is proven that technical analyzes themselves influence market sentiment, especially those that are more popular.

The technical analysis indicator analyzes for Bitcoin the 26 most popular stock market indicators and subdivides them into 2 main categories that differentiate them in their type of trend indicator or oscillator. Subsequently, each one of them is averaged and assigned a certain weight based on the popularity of each one. These results fairly accurately reflect the impact generated by these charts on market analysts.

Social Fear

Dominance Greed

This other indicator takes into account the dominance of Bitcoin with respect to the general market. When it gets greedy, altcoin investments greatly increase and the total market capitalization increases, which also decreases Bitcoin's dominance. The same thing happens when the market panics but in reverse. For this reason, both the token capitalization and the total market capitalization are calculated.

But there is also a correlation between the dominance of Bitcoin and the dominance of the main altcoins, so the indicator calculates different values for each cryptocurrency.

Search Fear

Trends is another factor that determines the sentiment of a particular market. We analyze the search volume on Bitcoin has on major search engines on Google.

The lookup indicator looks at the current value and compares it to previous values to determine what particular interest there is in Bitcoin. For this, specific search terms are used that determine the purchasing or ceding interest of Bitcoin, thus excluding general terms that only define popularity without demonstrating negativity or possibility.

Whales Greed

One of the analyzes that can determine the cryptocurrency market is the movement of whales.

CFGI analyzes the movements of superlative amounts made by large investors in two ways, first it analyzes large movements from wallets to exchanges of Bitcoin and compares them with the large movements of stable coins that are also made from wallets to exchanges to estimate the proportion of purchase and sale to be made.

A high ratio of Bitcoin moves to stablecoins indicates strong selling intent which means greed market, while a higher ratio of stablecoins moves indicates stronger buying intent and fear market.

Order Book Neutral

Another great predictor of sentiment through a quantitative source are the order books. Crypto Fear and Greed Index analyzes the order book for Bitcoin on a popular exchange to determine the buying and selling pressure that contiguous orders exert on the price. In such a way that you can know the buying and selling pressure that the orders which are going to be executed will exert.

Stronger buying pressure than selling pressure close to price is a clear indication of bearish sentiment, as there are more buy orders within equal distance to the price. While stronger selling pressure above price indicates a bullish sentiment, because there are more sells to execute than buys at the same distance.

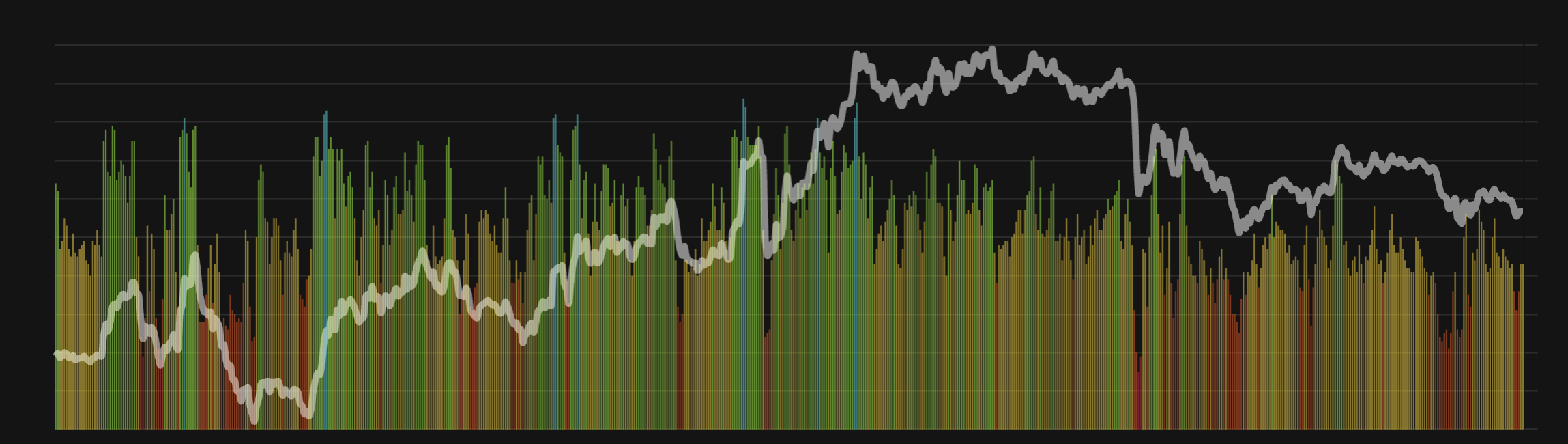

BTC Price

1 BTC = $78,801.50

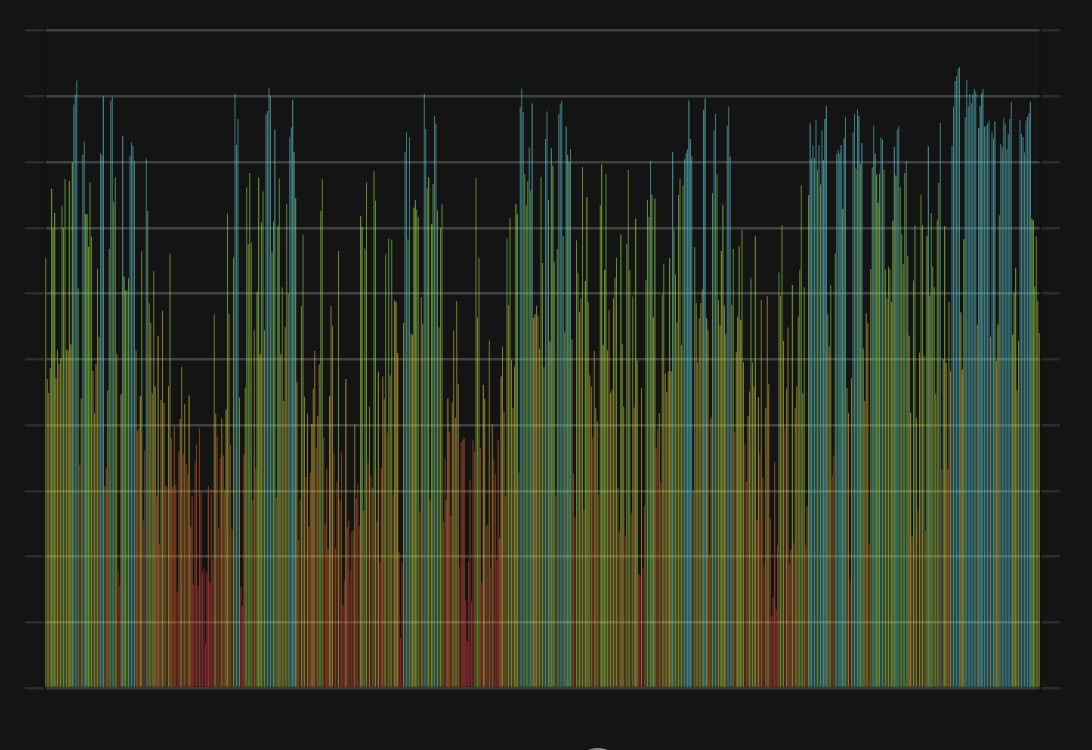

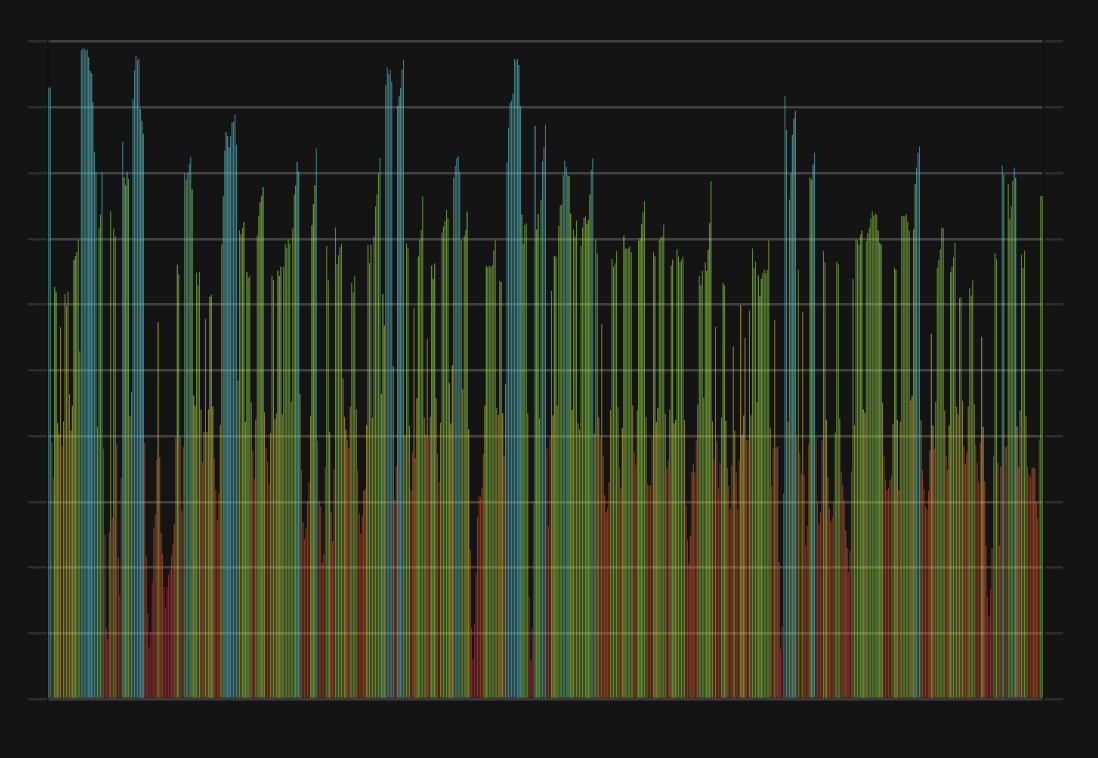

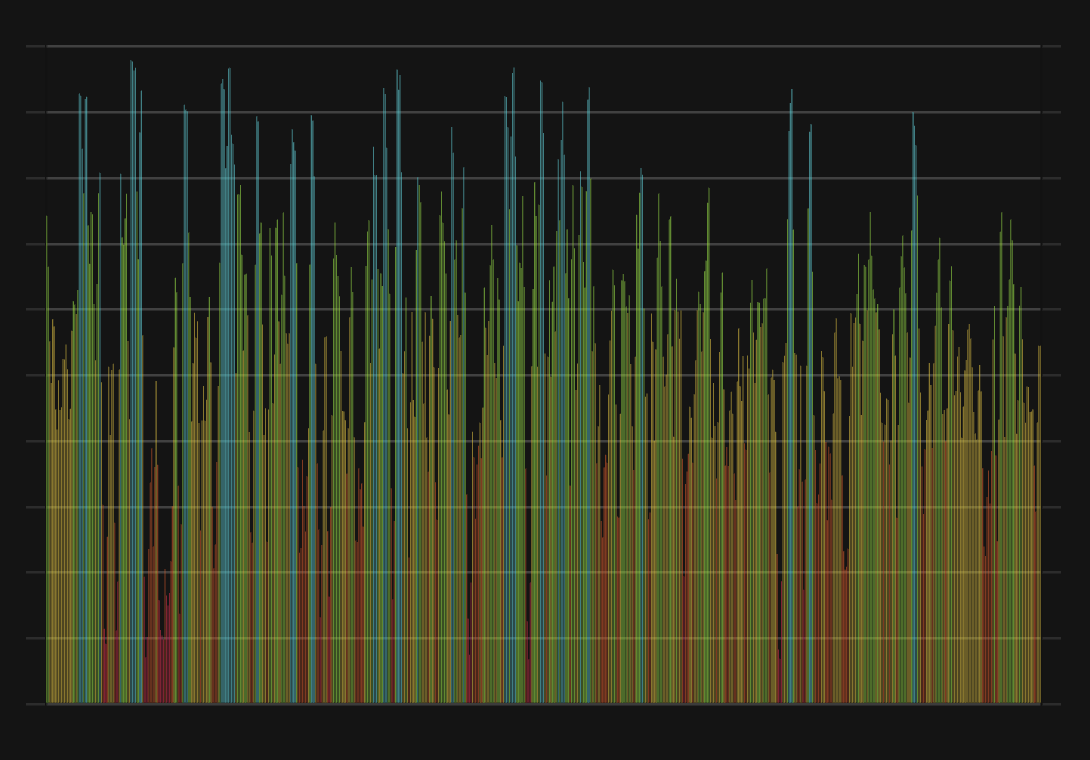

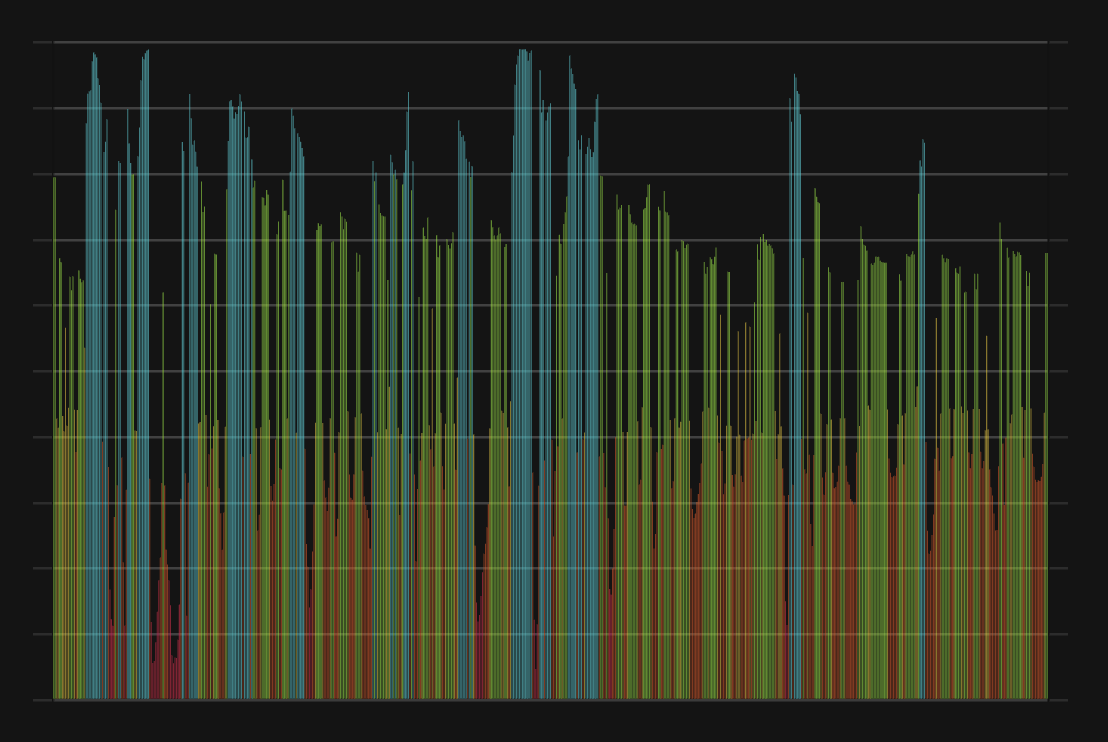

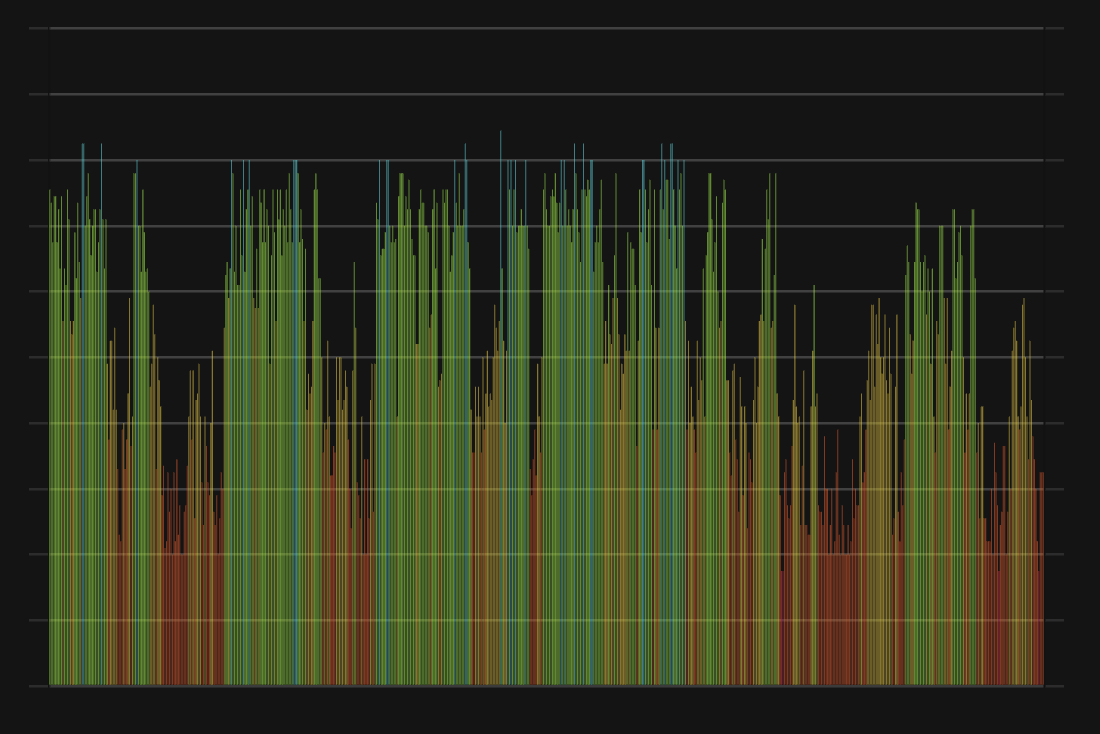

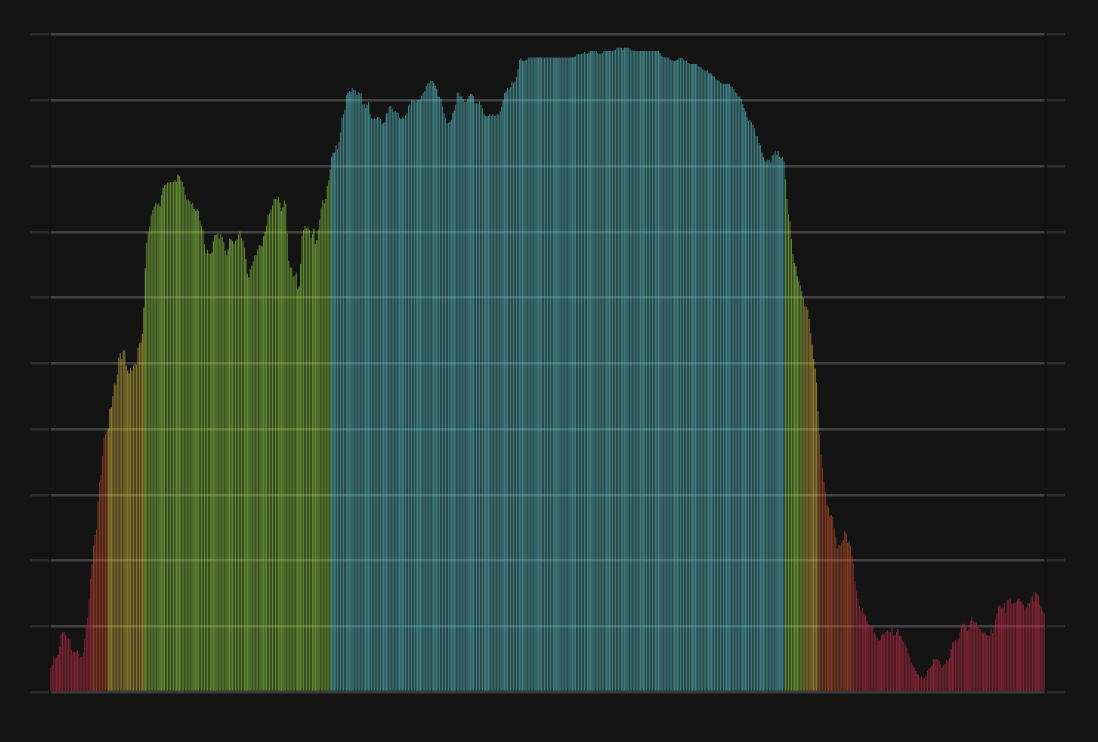

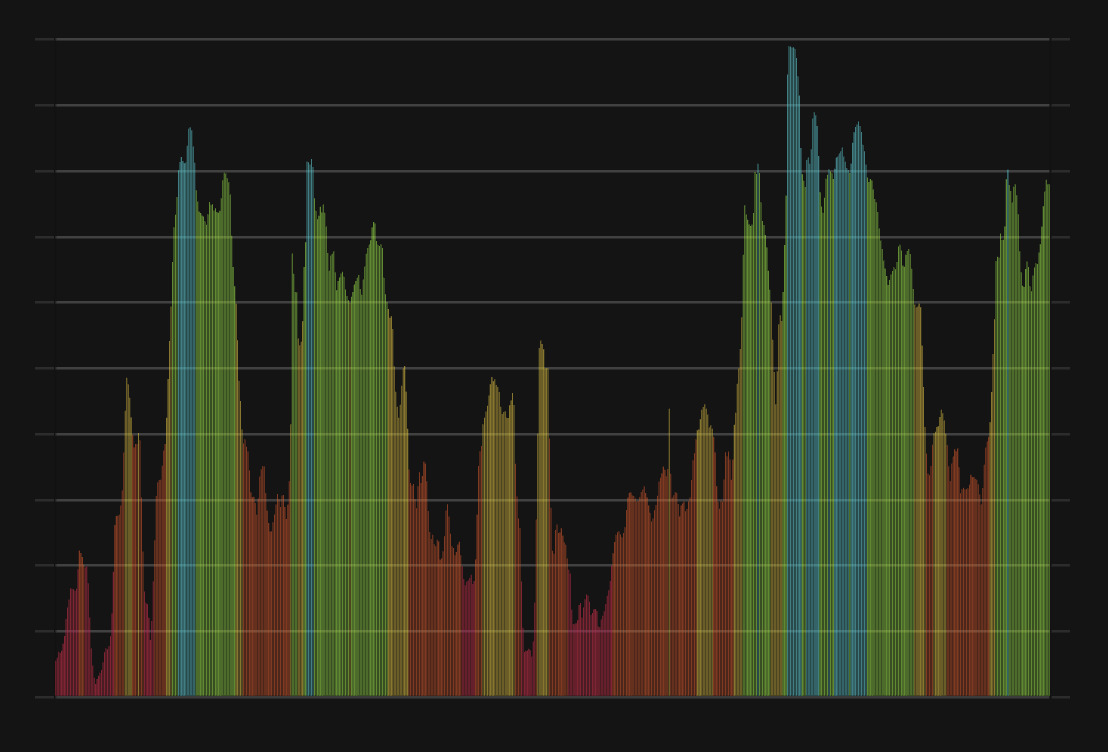

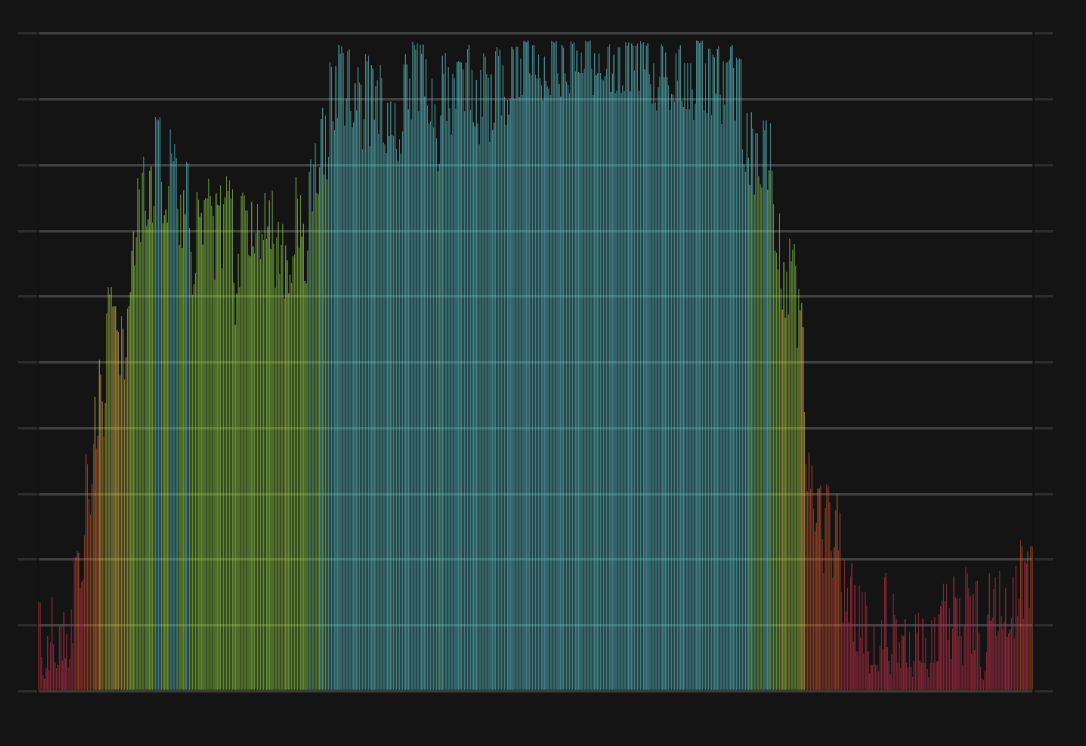

Bitcoin CFGI Score & BTC Price History

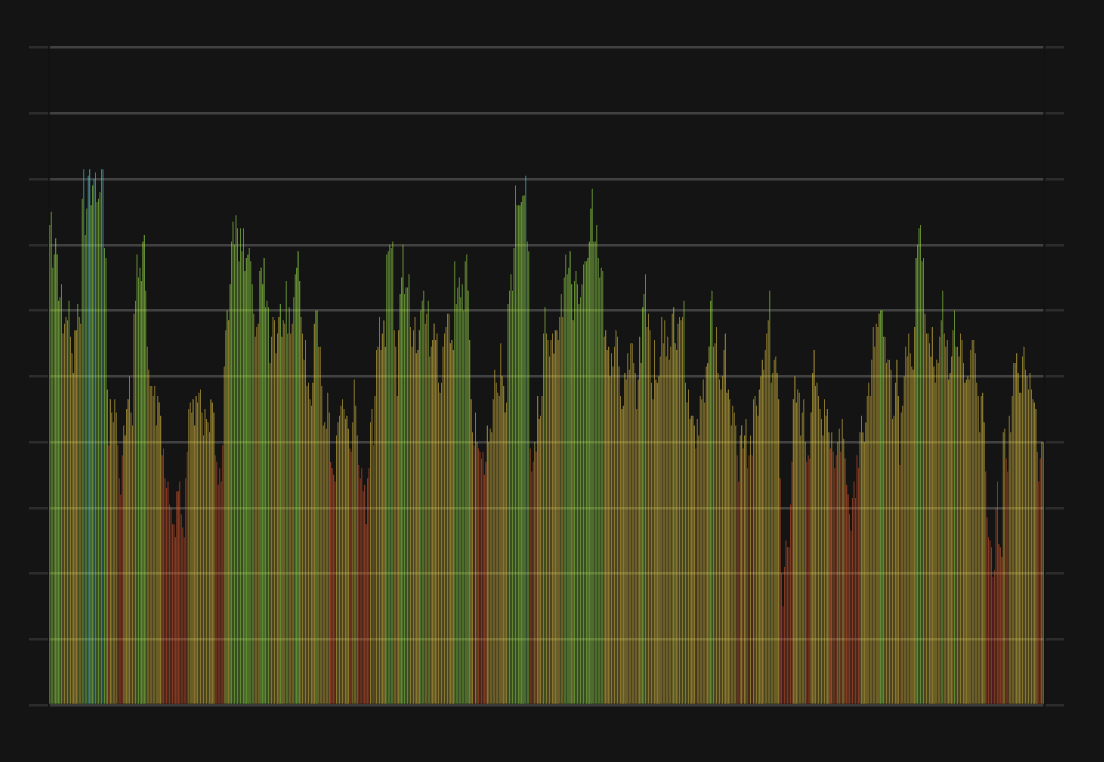

BTC Price & Bitcoin Sentiment Breakdown Charts

Price Score Sentiment

Volatility Sentiment

Volume Sentiment

Impulse Sentiment

Technical Sentiment

Social Sentiment

Dominance Sentiment

Search Sentiment

Whales Sentiment

Order Book Sentiment